Top Loans for Bad Credit with Flexible Repayment

Struggling with bad credit can feel like an uphill battle, especially when you need financial help. Whether it’s an unexpected expense, medical emergency, or a major purchase, finding a loan with bad credit can seem impossible. But don’t worry—bad credit loans are designed to help those with less-than-perfect credit.

What Are Loans for Bad Credit?

Loans for bad credit are financial products specifically designed for people with poor credit scores. Lenders who offer these loans understand that borrowers may have a history of missed payments, bankruptcy, or other financial challenges. While these loans often come with higher interest rates due to the perceived risk, they provide an opportunity for people with bad credit to get the funds they need.

How Does Bad Credit Affect Loan Approval?

Credit scores play a critical role in loan approval. A poor credit score indicates to lenders that you’re a high-risk borrower. As a result, traditional banks or credit unions may reject your loan application or offer unfavorable terms, like higher interest rates or lower loan amounts.

In contrast, lenders that specialize in bad credit loans are more flexible. They may focus on other factors like your income, employment history, or collateral rather than just your credit score.

Types of Loans for Bad Credit

Here are some common types of loans available for those with bad credit:

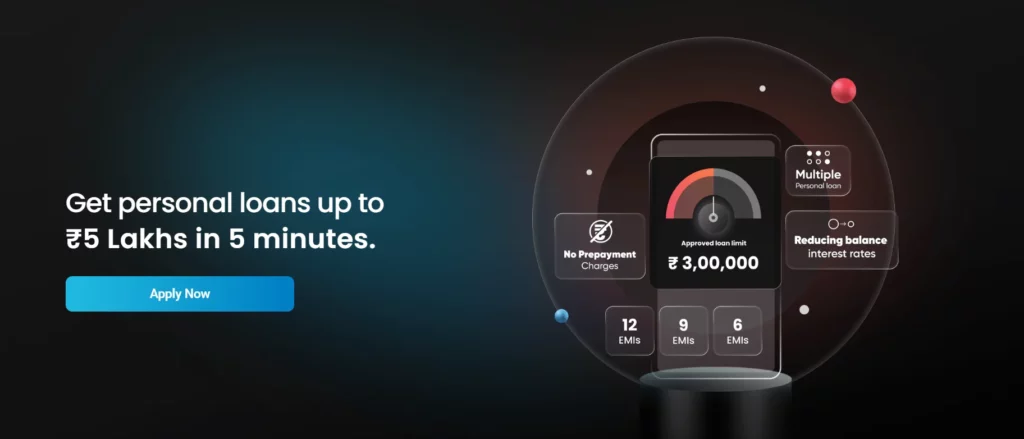

Personal Loans for Bad Credit

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, medical expenses, or home repairs. Although interest rates may be higher, many lenders offer personal loans for bad credit with flexible repayment options.

Secured Loans

Secured loans require collateral, such as a car, home, or savings account, which reduces the lender’s risk. Since the loan is backed by an asset, you may get lower interest rates, even with bad credit.

Payday Loans

Payday loans are short-term, small-dollar loans designed to cover expenses until your next paycheck. While these loans are easy to get, they often come with extremely high interest rates and should only be considered as a last resort.

How to Improve Your Chances of Getting a Loan with Bad Credit

While bad credit loans are available, you can take steps to increase your approval odds and even secure better terms. Here are a few tips:

Check Your Credit Report

Before applying for any loan, review your credit report to ensure there are no errors or fraudulent activities. Correcting mistakes could improve your credit score, which may help you qualify for better loan terms.

Offer Collateral

Offering collateral for a secured loan reduces the lender’s risk, making them more likely to approve your application and offer a lower interest rate.

Show Proof of Income

Lenders want to know that you have the ability to repay the loan. Providing proof of steady income, such as pay stubs or tax returns, can increase your chances of approval, even if your credit score is low.

Apply with a Co-Signer

A co-signer with good credit can help you get approved for a loan at a lower interest rate. If you fail to repay, the co-signer is responsible, which lowers the lender’s risk.

Compare Multiple Lenders

Don’t settle for the first offer you get. Shopping around and comparing offers from different lenders will help you find the best loan terms for your situation.

Risks of Bad Credit Loans

While bad credit loans offer a solution, they come with some risks:

Higher Interest Rates: Lenders charge higher interest rates to offset the risk of lending to borrowers with poor credit. This means you’ll pay more over the life of the loan.

Shorter Repayment Terms: Some bad credit loans, especially payday loans, have short repayment periods, making it difficult to repay the loan on time.

Scams and Predatory Lenders: Unfortunately, bad credit borrowers are often targeted by predatory lenders offering loans with unfair terms. Always research the lender and read the terms carefully before signing any agreement.

Alternatives to Bad Credit Loans

If you’re hesitant about taking a loan with bad credit, here are some alternatives:

Credit Counseling: Non-profit credit counseling agencies can help you create a debt management plan to pay off your debts without taking out a new loan.

Debt Consolidation: If you have multiple high-interest debts, consider a debt consolidation loan or balance transfer credit card with a lower interest rate.

Borrow from Family or Friends: While it can be uncomfortable, borrowing from someone you trust can be a way to avoid high-interest loans.

Conclusion

Having bad credit doesn’t mean you’re out of options when it comes to borrowing money. There are various bad credit loan options available that can help you secure the funds you need. However, it’s important to carefully weigh the terms and conditions of each loan, as well as consider alternatives, before making a decision.