Exploring Features of a Modern Bitcoin Investment App

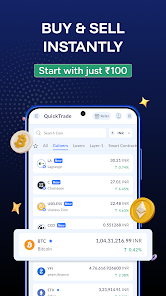

Digital finance has changed the way individuals approach long-term wealth building and short-term market participation. Among these changes, the rise of a bitcoin investment app has created new opportunities for users who prefer managing digital assets through mobile-first solutions. These applications are designed to simplify access to decentralized currencies while offering structured tools for monitoring value movement and transaction history.

A growing number of users now rely on a crypto trading platform to explore digital assets without navigating complicated interfaces. A well-built bitcoin crypto app focuses on clarity, functionality, and responsible access rather than overwhelming users with unnecessary features. Understanding how these apps function is essential before making any financial decisions.

Understanding the Purpose of a Bitcoin Investment App

A bitcoin investment app is built to help users buy, store, and track bitcoin through a digital interface. Unlike traditional financial tools, these apps are available around the clock and provide direct exposure to price movements.

The primary goal of such applications is accessibility. Users can view market changes, review transaction records, and manage balances in one place. When integrated properly, a crypto trading platform removes technical barriers and presents information in a way that is easier to interpret.

A bitcoin crypto app also supports self-directed decision-making. Instead of relying on intermediaries, users can independently observe trends and act based on their own understanding.

Core Features Found in Modern Bitcoin Investment Apps

User Interface and Navigation

Clarity in design is a key factor. A modern bitcoin investment app usually follows a clean layout with logical navigation. Users should be able to locate essential sections such as balances, transaction history, and price charts without confusion.

Simple navigation supports better engagement and reduces errors during transactions. A well-structured crypto trading platform prioritizes ease of use over excessive visual elements.

Real-Time Price Tracking

Price movement is central to digital asset participation. Most applications offer real-time price updates, allowing users to track fluctuations throughout the day.

A bitcoin crypto app typically includes historical charts that help users understand price behavior over different time periods. These charts support informed analysis rather than impulsive actions.

Secure Wallet Integration

Security is a foundational component. A bitcoin investment app often includes an integrated wallet to store digital assets. This wallet uses encryption and access controls to safeguard user funds.

Reliable apps also offer recovery mechanisms, ensuring users can regain access if credentials are lost. Security features should operate quietly in the background without complicating the user experience.

Role of Education Within the App Environment

Learning Tools for Beginners

Many users entering digital assets are unfamiliar with technical terms. To address this, a crypto trading platform may include educational sections explaining basic concepts, transaction processes, and risk considerations.

A bitcoin crypto app that offers learning material supports responsible usage. Education helps users understand both potential outcomes and limitations.

Market Insights and Data Presentation

Rather than predictions, well-designed apps focus on presenting raw data in an understandable format. Market summaries, volume indicators, and trend lines help users interpret conditions without external sources.

Providing context through data improves transparency and builds confidence among users who prefer evidence-based decisions.

Transaction Management and Record Keeping

Clear Transaction History

Transparency is essential for financial tracking. A bitcoin investment app typically includes a detailed transaction log showing dates, amounts, and status updates.

This record helps users review past activity and maintain accurate personal records. It also supports accountability when reviewing financial behavior over time.

Fee Visibility

Transaction costs should be visible before confirmation. A trustworthy crypto trading platform displays all applicable charges clearly, allowing users to evaluate the total cost of each action.

Fee transparency reduces misunderstandings and supports better planning.

Performance and Reliability Considerations

App Stability

A stable application ensures uninterrupted access during peak usage periods. Performance issues can lead to delays, which may impact user decisions.

A reliable bitcoin crypto app invests in infrastructure that supports consistent performance across devices and network conditions.

Update and Maintenance Practices

Regular updates improve security and usability. These updates may include interface refinements, performance improvements, or compliance adjustments.

Consistent maintenance reflects long-term commitment to user experience and system integrity.

Regulatory Awareness and Compliance Support

Although digital assets operate independently of traditional banking, regulatory awareness remains important. A responsible bitcoin investment app provides clear information regarding compliance requirements relevant to users’ regions.

This includes identity verification processes and transaction limits where applicable. Transparency in this area supports lawful usage and reduces future complications.

Evaluating a Bitcoin Investment App Before Use

Assessing Feature Balance

Not every app suits every user. Some prefer simplicity, while others require advanced tracking. Evaluating whether a crypto trading platform matches personal needs is an important step.

A bitcoin crypto app should offer balance, providing enough tools without unnecessary complexity.

Reviewing Security Measures

Before engaging with any application, users should review security protocols such as authentication methods and encryption standards. Security should be clearly explained rather than implied.

Understanding Limitations

No application guarantees outcomes. A responsible bitcoin investment app communicates both capabilities and limitations clearly, helping users set realistic expectations.

Conclusion: Making Informed Choices in Digital Asset Apps

Choosing the right bitcoin investment app involves more than downloading software. It requires understanding how features, security, and data presentation work together to support responsible participation. A well-structured crypto trading platform focuses on usability, transparency, and reliability rather than unnecessary additions.

By prioritizing clear navigation, secure storage, and accessible information, a bitcoin crypto app can serve as a practical tool for users exploring digital assets. Careful evaluation and informed usage remain essential, ensuring that decisions are guided by understanding rather than assumption.

As digital finance continues to evolve, users who take time to assess functionality and structure will be better positioned to navigate this space with clarity and confidence.