Popular Mutual Funds For Consistent Market Returns

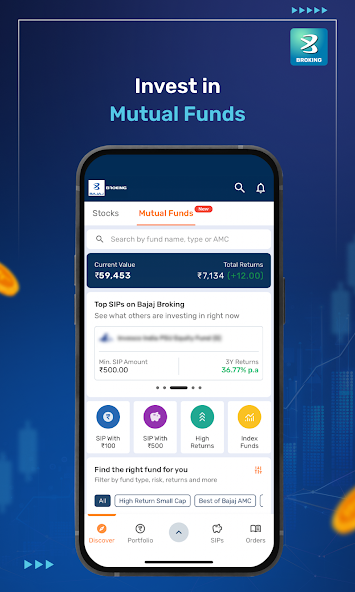

Investing has evolved significantly with the growing availability of digital platforms, research tools, and market access. Today, investors seek structured options that balance risk and return while aligning with long-term financial objectives. Popular mutual funds continue to be a preferred choice for individuals who want market exposure without direct stock selection. With the added convenience of an Indian Stock Trading App or a Mobile Trading App, tracking and managing mutual fund investments has become easier and more transparent.

Popular mutual funds are widely followed because of their consistent performance history, diversified asset allocation, and suitability for different investor profiles. Instead of reacting to short-term market movements, these funds focus on structured investment strategies that aim for steady growth over time.

Understanding Popular Mutual Funds

What Makes Mutual Funds Popular

Popularity in mutual funds is often driven by sustained performance, strong portfolio structure, and investor trust built over time. Funds that demonstrate consistency across market cycles tend to attract long-term investors rather than speculative participants.

Key reasons behind their popularity include:

- Diversified investments across sectors and assets

- Professional fund management

- Transparent performance tracking

- Accessibility through digital investment platforms

With a Mobile Trading App, investors can now review fund portfolios, monitor returns, and make informed decisions without complex processes.

Types of Popular Mutual Funds

Equity-Oriented Mutual Funds

Equity mutual funds invest primarily in shares of listed companies. These funds aim for capital appreciation over a longer period and are suitable for investors willing to accept moderate to high risk.

Common categories include:

- Large-cap focused funds

- Mid-cap and small-cap funds

- Broad market diversified funds

Using an Indian Stock Trading App allows investors to compare equity fund performance with broader market indices and historical data.

Debt-Based Mutual Funds

Debt mutual funds focus on fixed-income instruments such as bonds and money market securities. These funds aim to offer stability and predictable returns.

They are often chosen by:

- Conservative investors

- Individuals nearing financial goals

- Those seeking lower volatility

Debt funds play a key role in balancing portfolio risk when combined with equity funds.

Hybrid Mutual Funds

Hybrid mutual funds combine equity and debt investments within a single portfolio. This structure helps manage risk while providing growth potential.

Benefits include:

- Asset allocation within one fund

- Reduced portfolio volatility

- Suitable for moderate risk investors

Hybrid funds are often used as a foundation for long-term financial planning.

Why Popular Mutual Funds Aim for Consistent Market Returns

Diversification Across Market Segments

Diversification is a core principle of mutual fund investing. Popular mutual funds distribute investments across sectors, industries, and asset classes. This reduces dependency on any single stock or market segment.

As a result:

- Losses in one area may be offset by gains in another

- Market volatility impact is reduced

- Portfolio stability improves over time

Disciplined Investment Strategy

Consistency comes from following structured investment processes rather than reacting to daily market changes. Fund managers rely on research, valuation, and allocation principles to guide investment decisions.

Long-term discipline allows funds to:

- Navigate market corrections

- Benefit from economic cycles

- Maintain portfolio balance

Investors can observe this discipline clearly when tracking fund performance through a Mobile Trading App.

Role of Technology in Mutual Fund Investing

Digital Access and Transparency

Technology has simplified mutual fund investing for all types of investors. With an Indian Stock Trading App, individuals can access fund details, historical returns, and portfolio composition in real time.

Key advantages include:

- Easy comparison of multiple funds

- Clear visibility of investment value

- Simple monitoring of returns and holdings

This transparency supports informed decision-making rather than guesswork.

Systematic Investment Monitoring

Regular tracking helps investors stay aligned with financial goals. Digital platforms allow users to review performance periodically without frequent trading.

Through a Mobile Trading App, investors can:

- Check fund allocation changes

- Review long-term return trends

- Adjust investment amounts if required

This approach supports consistency rather than impulsive actions.

Factors to Consider Before Choosing Popular Mutual Funds

Investment Horizon

Mutual fund selection should match the time frame of financial goals. Equity-oriented funds are generally more suitable for long-term horizons, while debt funds fit shorter-term needs.

Aligning investment duration with fund type helps manage expectations and reduce risk.

Risk Tolerance

Understanding personal risk capacity is essential. Popular mutual funds are available across risk levels, making it important to select options that match comfort levels.

A balanced approach avoids unnecessary stress during market fluctuations.

Expense Structure

Costs associated with mutual funds affect overall returns. Reviewing expense details ensures that investments remain cost-efficient over time.

Digital platforms make these details accessible, helping investors compare options carefully.

Long-Term Benefits of Investing in Popular Mutual Funds

Wealth Accumulation Through Compounding

Consistent investing over time allows returns to compound, leading to gradual wealth creation. Popular mutual funds are designed to support this process by maintaining portfolio stability.

Regular investments, even with modest amounts, can result in meaningful growth over extended periods.

Reduced Emotional Decision-Making

Mutual funds reduce the need for frequent buying and selling decisions. Professional management and diversification help investors stay focused on long-term goals rather than short-term market movements.

This structured approach supports financial discipline.

Conclusion

Popular mutual funds remain a reliable investment option for individuals seeking consistent market returns without direct stock selection. Their diversified structure, disciplined management, and adaptability across market conditions make them suitable for a wide range of investors. With easy access through an Indian Stock Trading App and the convenience of a Mobile Trading App, managing mutual fund investments has become more efficient and transparent.

By focusing on long-term goals, understanding risk tolerance, and using digital tools wisely, investors can benefit from the stability and growth potential offered by popular mutual funds. Consistent investing, supported by informed decision-making, remains the foundation of successful mutual fund participation.