Smart Money Moves: Begin Your Journey With Mutual Funds

There’s a quiet dignity in making your money grow without noise. No flashy headlines, no impulsive “buy low, sell high” games. Just a steady, intentional planting of wealth, like tending to a garden that blooms when you’re not watching.

Welcome to the world of mutual funds, where growth is a process, not a race, and your financial future is shaped by patience, not panic.

To invest in mutual fund schemes today is to take a step not just towards financial security but towards a gentler kind of confidence, the kind that doesn’t scream “rich” but hums “stable.”

There’s no one-size-fits-all formula. Some people invest because they want to travel guilt-free. Some because they don’t want to depend on their children in old age. Some just want to be able to breathe between paychecks. Mutual funds adapt to those dreams. They carry your “why” with quiet loyalty.

You don’t need a million rupees. You need intent. You need one good decision , and the courage to stay with it.

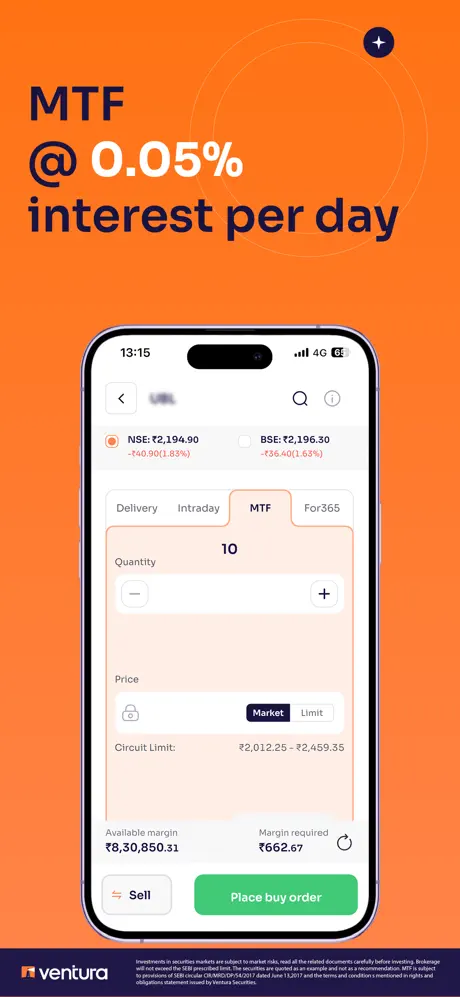

In an age where everything from groceries to therapy is just a swipe away, money management has found its digital soulmate, the mutual fund app.

Gone are the days of paperwork, bank visits, and long calls with confused advisors. Now, with a clean interface, a soft notification, and a few taps, you’re investing while waiting in line for coffee. It’s not just ease — it’s empowerment.

These apps are the pocket-sized mentors we didn’t know we needed. They whisper reminders: “Hey, your future is waiting,” without shouting. They simplify charts, offer curated funds, and track your journey like a map that keeps updating in real-time.

And the best part? You don’t need to know it all to start.

SIP in mutual funds, a Systematic Investment Plan is the grown-up version of saving in a piggy bank, only with a plan, returns, and fewer coins.

You choose an amount and pick a date, and the SIP quietly does its work in the background. No drama. No market-timing anxiety. Just consistency — the most underrated superpower of wealth-building.

Over months and years, SIPs become time capsules. You forget the money left you, but one day, it returns, matured, multiplied, and carrying interest like souvenirs from a future you dared to believe in.”

The term mutual fund SIP may sound technical, even cold, but there’s warmth in its design. It’s built for people who don’t have the luxury to risk everything.

When you opt for a mutual fund SIP, you’re not just investing money. You’re investing in character. Discipline. Hope. And those things, in the long run, compound far more beautifully than rupees ever could.

It teaches you that wealth isn’t sudden. It’s stitched slowly like a sari passed down through generations.

You don’t need to be a financial expert to understand the power of compounding. Imagine planting a seed every month. For the first year, there’s barely a bud. The second year, you wonder if it’s worth it. By the fifth, a small tree. By the tenth, fruit. Twenty years in, you’re sitting in shade you planted during your confused twenties.

That’s the SIP story. That’s the mutual fund story. That’s your story, if you start now.