Instant Loans Vs. Traditional Bank Loans: What’s For You?

Financial requirements can hit individuals any time and with technology, there are multiple options available for each need. Two such tools are instant loans and traditional bank loans, with different terms and conditions. These tools need our share of attention to detail and that’s why we will walk you through the meaning, pros, differences and everything around the two tools today.

Instant Loans Speed and Convenience

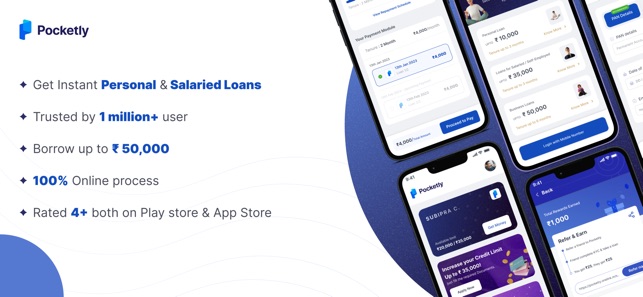

An instant loan, also known as a salaried personal loan or cash advances, are designed to give quick access to finances for critical charges. These loans generally involve minimum paperwork and can be reused within a short period, frequently within many hours, or indeed twinkles. The convenience of instant loans makes them a seductive option for individuals facing extreme circumstances or unanticipated bills.

Traditional Bank Loans Stability and Flexibility

On the other hand, conventional bank loans or creditline offer stability and flexibility that may not be set up with instant loans. Banks generally bear a more expansive operation process, including credit checks and attestation of income and means. While this can affect a longer blessing timeline, traditional bank loans frequently come with lower interest rates and more favorable terms.

crucial Differences to Consider

When deciding between instant loans and traditional bank loans, several crucial differences should be taken into account.

Blessing Process Instant loans generally have a streamlined blessing process, while traditional bank loans may bear further time and attestation.

An interest rate personal loan frequently comes with advanced interest rates compared to bank loans, which offer competitive rates for borrowers with good credit.

Repayment Terms Instant loans are generally short- term loans that must be repaid with the borrower’s coming payday. In discrepancy, traditional bank loans may offer longer prepayment terms, making them more manageable for some borrowers.

Credit Conditions Instant loans are frequently available to individuals with poor or no credit history, making them easily accessible to a broader range of audience. Traditional bank loans may bear a minimal credit score for blessing.

Loan Amounts Instant loans generally offer lower loan quantities compared to traditional bank loans, which may be suitable to give backing for larger charges.

Choosing the Right Option for You

Eventually, the choice between instant loans, through apps like Fibe, and traditional bank loans depends on your specific fiscal situation and needs. Still, an instant loan is the most suitable option if you have immediate finances for an emergency expenditure and have limited time to spare. Still, if you have the luxury of time and are seeking a lower interest rate or farther flexible prepayment terms, a traditional bank loan may be a better fit.

It’s important to precisely estimate the terms and conditions of each loan option and consider the implicit long-term counter accusations on your fiscal health. Also, exploring indispensable sources of backing, similar to credit unions or online lenders, can give fresh options to consider.

Conclusion:

Both instant loans from an app like Cashe and traditional bank loans serve distinct purposes and offer unique benefits. By understanding the differences between the two and assessing your fiscal requirements, you can make an informed decision that aligns with your pretensions and circumstances.