The Risks And Rewards Of Investing In Share Market

One Of The Best Methods To Build Wealth Is Through Stock Investing. Many People Invest In Equity To Achieve Financial Security And Long-Term Goals. Before Investing In Stocks, You Must Grasp The Pros And Cons.

- Share Investment Benefits:

Share Investing Offers Higher Returns Than Savings Or Fixed Deposits. Invest In Shares That Perform Well Can Accumulate Value. Some Corporations Pay Dividends, Giving Investors A Constant Passive Income While Keeping Their Shares. These Dividends Can Be Reinvested To Build Wealth.

Shares Give You Ownership In A Company, Giving You A Stake In Its Growth And Success. You May Also Have Voting Rights In Shareholder Meetings To Influence Significant Company Decisions. Liquid Stocks Are Easy To Purchase And Sell According To Market Conditions, Giving Them More Flexibility Than Other Investments. Stock Investments Can Be Liquidated Rapidly, Unlike Real Estate Or Fixed Deposits.

Stock Investing Diversifies Portfolios. By Investing Across Industries, Investors Can Reduce Market Risk. Choosing Equities From Diverse Industries Helps People Manage Risk And Return.

- Market Volatility And Risks:

Share Investing Can Be Profitable But Risky. Economic Conditions, Corporate Performance, And Global Events Affect Stock Values. Investors Follow The Nifty Index To Understand Market Trends And Make Decisions. The Nifty Index, Which Tracks The Top NSE India Firms, Is A Key Stock Market Benchmark.

Capital Loss Is Another Important Concern. While Fixed-Income Investments Guarantee Returns, Equities Do Not, And Bad Performers Can Cause Financial Losses. Stock Investment Is Difficult Due To Share Price Volatility Caused By Business Profits And Industry Developments. Market Crashes, Economic Downturns, And Geopolitical Conflicts Can Cause Large Losses.

Emotional Investing Must Be Considered. Panic Selling During Market Downturns And Excessive Buying During Bull Markets Are Common Impulsive Behaviours. Avoiding These Mistakes Requires A Well-Planned Investment Strategy And Discipline.

- NSE India’s Stock Market Investment Role:

The NSE India Helps Stock Trading In India. A Transparent And Efficient Trading Platform For Investors Buying And Selling Shares. The Stock Exchange Has Many Companies, Giving Investors A Wide Selection Of Sectors To Choose From. Knowing How NSE India Works Might Help Investors Make Smarter Financial Decisions And Reduce Risk.

- Managing Risk With Investment Apps And Margin Calculators:

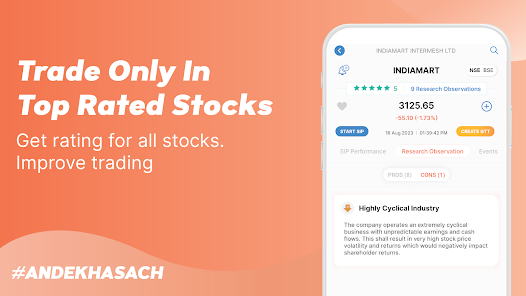

Real-Time Data And Market Insights From Investment Apps Can Reduce Risk And Improve Decision-Making. Trading Apps Let Traders Follow Stock Performance, Analyse Market Patterns, And Execute Trades Efficiently. Investment Apps With Automatic Trading, Portfolio Analysis, And Market News Alerts Are Vital For Beginners And Experts.

Margin Traders Benefit From Calculators. The Tool Helps Traders Choose Leverage With Minimal Risk. Overleveraging Can Cause Major Losses, Thus Margin Calculations And Management Are Crucial. A Margin Calculator Helps Investors Assess Leveraged Investment Returns And Risks.

Conclusion:

Share Investing Can Be Lucrative, But It Takes Forethought And Risk Evaluation. Investors Can Make Smart Financial Decisions By Following The Nifty Index, Using Reputable Investment Applications, And Employing Margin Calculators. Investors May Maximise Returns And Minimise Risk By Following NSE India Market Trends And Understanding Stock Trading.

Stock Market Success Requires Discipline, Whether You Invest For Long-Term Wealth Creation Or Short-Term Rewards. Through Strategy, Expertise, And Tools, Investors Can Handle Market Turbulence And Make Profitable Investments. Risk And Reward Analysis Is Crucial To Building A Profitable Investment Portfolio.